Ginkgo Bioworks Holdings, Inc. (NYSE:DNA – Get Rating) insider Reshma P. Shetty sold 162,193 shares of the firm’s stock in a transaction that occurred on Thursday, January 19th. The shares were sold at an average price of $1.71, for a total transaction of $277,350.03. Following the completion of the sale, the insider now directly owns 16,142,867 shares in the company, valued at approximately $27,604,302.57. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

Ginkgo Bioworks Holdings, Inc. (NYSE:DNA – Get Rating) insider Reshma P. Shetty sold 162,193 shares of the firm’s stock in a transaction that occurred on Thursday, January 19th. The shares were sold at an average price of $1.71, for a total transaction of $277,350.03. Following the completion of the sale, the insider now directly owns 16,142,867 shares in the company, valued at approximately $27,604,302.57. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

Ginkgo Bioworks Stock Performance

→ The Next Big Crisis Is Here (From Porter & Company)

DNA traded down $0.01 on Friday, reaching $1.66. The company had a trading volume of 14,075,639 shares, compared to its average volume of 20,992,719. The stock has a 50-day moving average price of $1.85 and a 200-day moving average price of $2.54. Ginkgo Bioworks Holdings, Inc. has a 1 year low of $1.45 and a 1 year high of $6.38. The company has a quick ratio of 11.67, a current ratio of 11.71 and a debt-to-equity ratio of 0.04. The stock has a market capitalization of $3.22 billion, a PE ratio of -0.72 and a beta of 0.68.

Ginkgo Bioworks (NYSE:DNA – Get Rating) last announced its earnings results on Monday, November 14th. The company reported ($0.40) EPS for the quarter, missing analysts’ consensus estimates of ($0.25) by ($0.15). Ginkgo Bioworks had a negative net margin of 668.49% and a negative return on equity of 85.90%. The business had revenue of $66.40 million during the quarter, compared to analysts’ expectations of $54.28 million. As a group, research analysts forecast that Ginkgo Bioworks Holdings, Inc. will post -1.41 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Ad Porter & Company

Is This The End of Capitalism?

EXPOSED: The establishment plot to disenfranchise and impoverish millions of Americans…

DNA has been the topic of several analyst reports. BTIG Research reduced their target price on shares of Ginkgo Bioworks to $4.00 in a report on Thursday, November 17th. Berenberg Bank initiated coverage on shares of Ginkgo Bioworks in a report on Monday, November 28th. They issued a “buy” rating and a $6.00 target price on the stock. Morgan Stanley initiated coverage on shares of Ginkgo Bioworks in a report on Tuesday, October 4th. They issued an “equal weight” rating and a $5.00 target price on the stock. Finally, Raymond James reduced their target price on shares of Ginkgo Bioworks from $10.50 to $6.00 and set an “outperform” rating on the stock in a report on Tuesday, November 22nd. One investment analyst has rated the stock with a sell rating, two have given a hold rating and four have given a buy rating to the company. According to MarketBeat, Ginkgo Bioworks presently has an average rating of “Hold” and an average price target of $5.92.

Institutional Investors Weigh In On Ginkgo Bioworks

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Bourgeon Capital Management LLC purchased a new stake in shares of Ginkgo Bioworks in the fourth quarter valued at about $722,000. Rothschild Investment Corp IL purchased a new position in Ginkgo Bioworks during the fourth quarter worth about $105,000. Private Advisor Group LLC purchased a new position in Ginkgo Bioworks during the fourth quarter worth about $25,000. Maryland State Retirement & Pension System purchased a new position in Ginkgo Bioworks during the fourth quarter worth about $107,000. Finally, Wealth Alliance Advisory Group LLC purchased a new position in Ginkgo Bioworks during the fourth quarter worth about $31,000. 61.83% of the stock is owned by hedge funds and other institutional investors.

Ginkgo Bioworks Company Profile

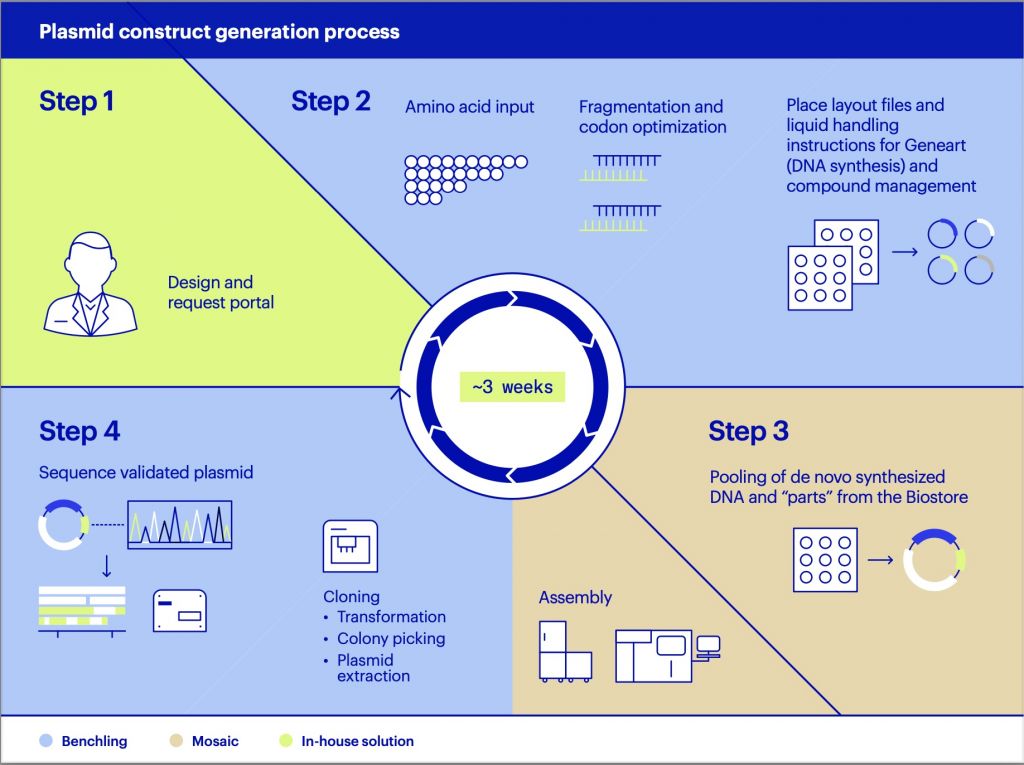

Ginkgo Bioworks Holdings, Inc, together with its subsidiaries, develops platform for cell programming. Its platform is used to program cells to enable biological production of products, such as novel therapeutics, food ingredients, and chemicals derived from petroleum. The company serves various end markets, including specialty chemicals, agriculture, food, consumer products, and pharmaceuticals.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ginkgo Bioworks, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Ginkgo Bioworks wasn’t on the list.

While Ginkgo Bioworks currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.