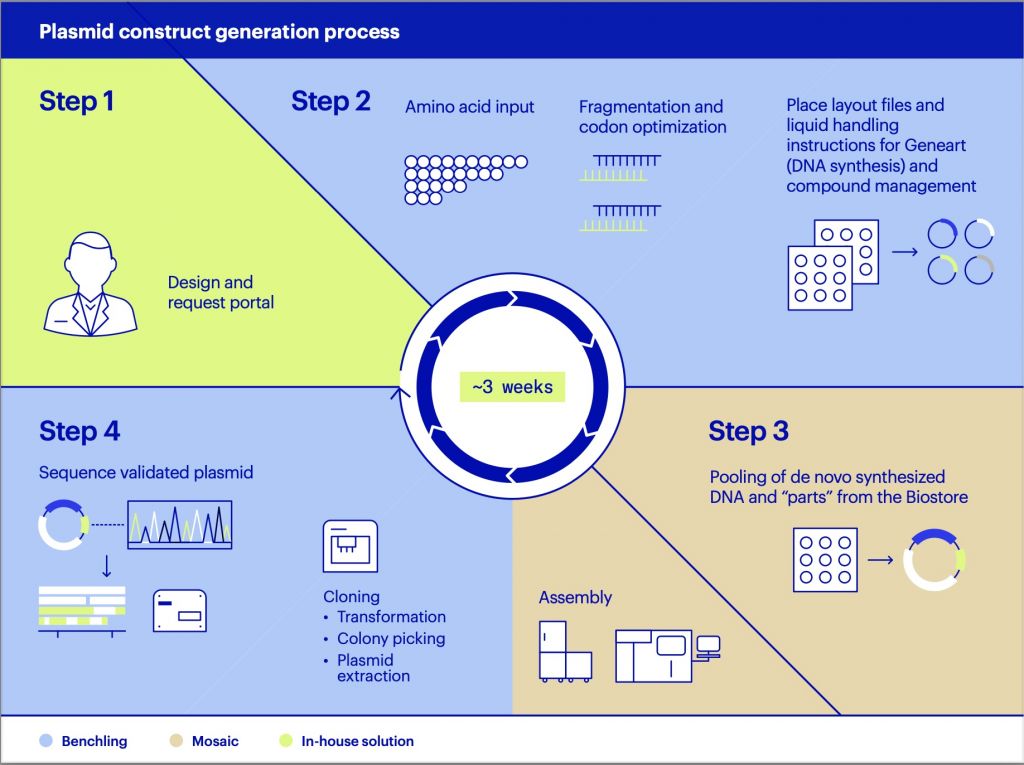

These tech titans know a good thing when they see it, and they’re investing big-time in synthetic biology.

SynBioBeta

“DNA is like a computer program but far, far more advanced than any software ever created.” Bill Gates wrote this in 1995, long before synthetic biology – a scientific discipline focused on reading, writing, and editing DNA – was being harnessed to program living cells. Today, the cost to order a custom DNA sequence has fallen faster than Moore’s law; perhaps that’s why the Microsoft founder is turning a significant part of his attention, and wallet, towards this exciting field.

Known as the Carlson curve, the cost of reading and writing DNA — the machinery of life, the universe, and everything — is plummeting at a rate that makes Moore’s law blush. It’s a key factor catalyzing a new biomanufacturing revolution.

Image: SynBioBeta, Data: courtesy Rob Carlson / SynBioBeta.

Bill Gates is not the only tech founder billionaire that sees a parallel between bits and biology, either. Many other tech founders – the same people that made their money programming 1s and 0s – are now investing in biotech founders poised to make their own fortunes by programming A’s, T’s, G’s and C’s.

Funding for synthetic biology companies, 2009–2018. 98 synthetic biology companies raised almost USD$4 billion last year. Many of those investors are coming from the tech industry, which knows how to ride an exponential.

SynBioBeta.

The industry has raised more than $12.3B in the last 10 years and last year, 98 synthetic biology companies collectively raised $3.8 billion, compared to just under $400 million total invested less than a decade ago. Synthetic biology companies are disrupting nearly every industry, from agriculture to medicine to cell-based meats. Engineered microorganisms are even being used to produce more sustainable fabrics and manufacture biofuels from recycled carbon emissions.

The number of synthetic biology companies formed has increased greatly throughout the last 18 years with 620 new companies formed in 2018.

SynBioBeta.

This remarkable versatility, and the notion that biology can be programmed much like a computer, has attracted investors that want to “pay it forward” to the next generation of entrepreneurs. Data Collective, where I’m an Operating Partner, has made numerous investments in synthetic biology companies. Large investments have also come from tech titans like Eric Schmidt (Google), Peter Thiel (PayPal), Vinod Khosla (Sun Microsystems), Marc Andreessen (Netscape), Jerry Yang (Yahoo!), Bill Gates (Microsoft), Bryan Johnson (Venmo), and Max Levchin (PayPal), each of whom have made highly successful exits and are now fostering a golden new age in the engineering and programming of biology.

Former Google CEO Eric Schmidt is one of the world’s most successful business leaders and arguably one of the Internet’s most important people. In 2010 he co-founded Innovation Endeavors, an early-stage venture capital firm that believes that recent advances in science and technology will create exponential rates of change and emergent ecosystems in a new world. The firm has invested in synthetic biology-enabled companies including Zymergen, Bolt Threads, Ukko, and GRO Biosciences.

In articles and interviews over the years, Peter Thiel has repeatedly discussed the ‘Stagnation Hypothesis’, which suggests that breakthroughs have been lacking in a broad number of fields over the last 50 years, including biology. Despite this stagnation, he says, “computers have become the single great hope for the technological future.” It’s not surprising, then, that Thiel is leveraging software-based solutions to search for biological breakthroughs.

Founders Fund, where Thiel is a partner, has invested in some of the leading synthetic biology companies, especially those that are offering cloud-based platforms to perform experiments remotely. Consider Emerald Cloud Lab, a South San Francisco-based warehouse of sorts filled with a slew of million-dollar robots. Users can log on to their website from anywhere in the world, enter the experimental protocol that they’d like to perform, and the robots here take care of the rest. Entire experiments, which would normally take scientists weeks, are performed in hours with higher precision. And though the idea sounds crazy on paper, it’s exactly the sort of “internet-based solution” that Silicon Valley loves.

Some of the tech founders now investing in synthetic biology.

SynBioBeta

Vinod Khosla, co-founder of Sun Microsystems (which developed Java, among many other things), also sees promise in robot-aided experiments. But rather than outsource experiments to a warehouse in San Francisco, he wants to put robots directly into the hands of end-users. That’s why his VC fund, Khosla Ventures, has invested in Brooklyn-based Opentrons, a company that sells open-source, automatic pipetting robots that can run entire experimental workflows. It’s part of an ongoing trend in synthetic biology that aims to put automated solutions into the hands of scientists.

Rather than having robots perform tedious experiments in lieu of humans, other companies are empowering scientists directly by providing web-based solutions that make biology easier to engineer. Benchling, which recently raised a $34.5M series C, allows users to store, edit, catalog and analyze DNA sequences online. They also offer tools for users to engineer DNA digitally, so that scientists can plan their experiments and test them without ever picking up a pipette. The problem here is that DNA is tough to engineer, and the solution again comes in the form of software. Maybe that’s why Marc Andreessen, the pioneer behind the Netscape browser, is a backer via his fund Andreesen Horowitz.

Jerry Yang, the Yahoo! co-founder and Founding Partner at AME Cloud Ventures, also sees some obvious parallels between biology and bits – as in, what if DNA could literally store digital information. That’s why he invested in Catalog, a Boston-based company using synthetic biology to do exactly that. According to The Economist, Catalog’s method can store 20,000x more information than hard drives in the same amount of space – or, in other words, 600 billion gigabytes of data in one cubic meter. I previously wrote about the many recent, technological leaps that have enabled DNA to function as a viable medium for digital storage.

But not every tech founder is limiting their investments in synthetic biology to cases where software offers an obvious parallel. Bill Gates has repeatedly invested in the “food revolution”, backing both Impossible Foods and Memphis Meats, two companies offering meat replacements, but doing so in completely different ways. Impossible Foods makes their burgers from plant-based ingredients, while Memphis Meats uses biotechnology to literally grow meat from living cells, instead of butchering animals.

Max Levchin, another PayPal co-founder, is an investor in Emeryville-based Bolt Threads, a company wielding ‘designer’ microbes to produce synthetic silks and engineered mushrooms to mimic leather. These bio-crafted materials are not all hype, either. Bolt Threads has already manufactured and shipped products, including a men’s necktie and a commercially-available bag that originally launched on Kickstarter.

Bryan Johnson founded and successfully sold his online and mobile payments provider, Braintree (which created Venmo), to PayPal in 2013 for $800M. In 2014, Bryan invested $100M to start OS Fund to support inventors and scientists who aim to benefit humanity by rewriting the operating systems of life. His OS Fund investments include endeavors to cure age-related diseases and radically extend healthy human life beyond 100 years, make biology a predictable programming language, digitize analog businesses, and reimagine food using biology, among others. OS Fund’s portfolio includes Arzeda, Catalog, GRO Bioscience, Ginkgo Bioworks, HelixNano, Lygos, Pivot, Synthego, and Synthetic Genomics.

So, while we still have a long way to go before biology is easy to engineer or offers solutions to all the world’s problems, maybe the next breakthroughs will be inspired by the same people that made the internet and software booms a reality. In most cases, tech founders are investing in synthetic biology because they see a real opportunity to make an impact on the world by leveraging their expertise in software and customer-oriented businesses — they just want to apply their skills to harder problems.

And what problem is harder than synthetic biology, where atoms are programmed instead of bits?

Note: I am the founder of SynBioBeta, the innovation network for the synthetic biology industry. Some of the companies that I write about sponsor the SynBioBeta conference (click here for a full list of sponsors).